Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

In the context of shell scripting, the "wh" command is usually used to refer to the "while" loop, which allows a section of code to be repeated while a certain condition is true.

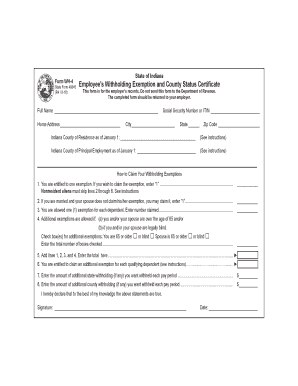

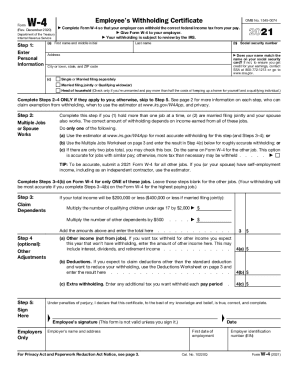

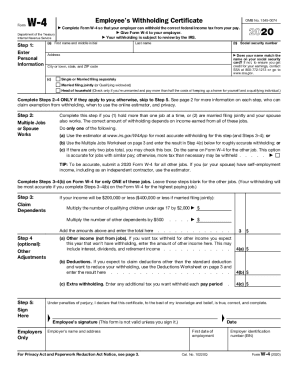

Who is required to file in wh 4?

The WH-4 form is used by employers in Wisconsin to determine the number of state income tax withholding allowances for their employees. All employers in Wisconsin are required to file the WH-4 form for each of their employees.

What is the purpose of in wh 4?

In wh 4 is a type of question used to ask for clarification or further information about a particular subject. It is often used in conversation to help a person better understand the context of the conversation.

What is the penalty for the late filing of in wh 4?

The penalty for the late filing of a Form W-4 is a $500 fine.

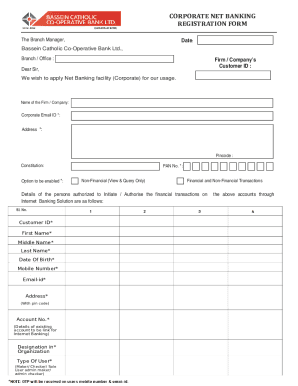

To fill out an In Wh-4 form, follow these steps:

1. Start by obtaining a blank In Wh-4 form from your employer, payroll department, or any reliable source. You can also usually find the form online on your state's department of revenue or taxation website.

2. Provide your personal information: Begin by entering your full name, address, and social security number in the designated fields. Make sure to provide accurate and up-to-date information.

3. Complete your filing status and allowances: In the next section, choose your filing status by checking the appropriate box (e.g., Single, Married, or Head of Household). Then, specify the number of allowances you wish to claim, which affects the amount of tax withheld from your paycheck. The higher the number of allowances, the less tax is withheld.

4. Calculate additional withholding: If you want to have more tax withheld from each paycheck, you can enter an additional dollar amount in this section. It can be useful for individuals who anticipate owing more tax or want to ensure they don't owe a large sum at the end of the year.

5. Exempt status: If you qualify for tax exemption, check the box provided to indicate that you are claiming exemption from withholding. This is typically applicable if you had no tax liability in the previous year and expect the same for the current year. However, eligibility criteria may vary by state, so it is essential to review the specific guidelines.

6. Signature and date: Sign and date the form at the bottom to certify the accuracy of the information provided.

Note: It is always advisable to consult with a tax professional or refer to the instructions provided with the form to ensure that you are completing it correctly for your specific situation. Additionally, remember to submit the form to your employer or payroll department as instructed, ideally before the first paycheck of the year.

What information must be reported on in wh 4?

The WH-4 form, also known as the Employee's Withholding Certificate, is used by employees to indicate their federal income tax withholding for the year. The information that must be reported on the WH-4 form typically includes:

1. Personal Information: This includes the employee's name, address, Social Security number, and filing status (e.g., single, married filing jointly, etc.).

2. Exemptions: The employee must report the number of exemptions they are claiming on their tax return. This determines the amount of tax the employer withholds from their paycheck.

3. Additional Withholding: If the employee wants to request additional federal tax withholding from their paycheck, they can indicate the additional amount on the WH-4 form.

4. Signature: The employee must sign and date the form to certify that the information provided is accurate.

It's important to note that the specific requirements for reporting information on the WH-4 form may vary based on state and employer policies. Therefore, employees should refer to the instructions accompanying the form to ensure they correctly report the required information.

How do I modify my in wh4 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your indiana withholding certificate form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send indiana wh4 for eSignature?

To distribute your indiana form employee, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the in wh 4 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.